The private equity industry has found itself in a unique position resulting from the aftermath of COVID-19. With limited access to federal assistance relief and unclear eligibility guidelines, PE firms and their portfolio companies have had to get creative in harnessing strategies to minimize disruptions and maintain business continuity. Now that the United States has officially entered recession territory and workforces have largely adjusted to operating remotely, it is the right time for private equity professionals to look ahead to their recovery plans.

However, not all industries are at the same stage of recovery from this pandemic. An approach to investing in restaurant businesses looks very different than investing in software-as-a-service tech firms right now. As deal flow picks up and with due diligence being hampered in a remote environment, the need to be aware of specific pain points—and opportunities—is more important than ever.

For Certain Industries, Headwinds Prevent Headway

Private equity investing is a relationship-driven business and strong integration between the firm and portfolio company or acquisition target is critical. However, the past few months have thrown that balance off. COVID-19 triggered severe market dislocation, which brought about significant, non-seasonal, systemic reductions in demand for non-essential goods and increased demand for essentials. It also took out of the equation the ability to get in a room together and work through the crisis in person. As a result, portfolio companies and targets in particular industries, such as healthcare, retail, restaurants, and manufacturing, were left grappling with how to fight through multiple crises at once—one of health, of economics, and of workplace stability.

For potential acquisition targets, private equity firms are reexamining deals that were initiated pre-coronavirus to rethink deal structure and purchase price. The most successful private equity firms are those that will be able to separate out the eventual winners at a time when entire industries have been battered. Private equity firms who are able to value targets effectively in a distressed marketplace, looking at everything from internal controls to customers, the supply chain, and industry-specific challenges and opportunities, will set themselves—and their investors—up well for the decade to come.

For existing portfolios, guidance from private equity owners becomes more valuable when business is anything but “usual.” Times of crisis and economic downturn such as this offer private equity the unique position to be able to add value not just in working capital and financial liquidity, but also with crisis response and management. Fund managers should be increasing the frequency of communication touchpoints with portfolio company teams to address market softness and liquidity constraints more proactively. Supporting management functions can range from staying up-to-date on government programs to talking with human-resource consultants to helping modify crisis response plans to conducting business continuity risk assessments. This role becomes especially vital for these hardest-hit industries during their most vulnerable period so they can focus on running day-to-day operations as they strive to keep their doors open.

Opportunities with “Tailwind” Sectors

No industry has been immune to the effects of COVID-19, even those that experienced tailwinds. And as the appetite for deal activity intensifies, private equity firms will no longer contend with operating with austerity, and instead begin to shift back to acquisition mode. In fact, the competitive nature of the private equity market is slowly restoring as several funds are announcing new deals that were actually lined up in the funnel pre-pandemic.

Even sectors like technology, which have emerged as winners during the pandemic, have faced their own set of unique challenges regarding meeting increased demand. Yet, the technology industry overall is in a strong position and is likely spared from prominent traditional supply chain issues. Investors may be more eager to get involved in these industries but should still be cautious of the pitfalls they’ve faced as well.

For tech companies, significant cybersecurity and data privacy-related vulnerabilities—and relevant legal or legislative impacts—that have emerged from excessive demand likely warrant a priority reassessment in addition to adjusting forecasts. These are important considerations for potential private equity investors when evaluating potential opportunities as they are conducting due diligence.

When distinguishing between businesses that have seen increased revenue during this pandemic, in addition to traditional metrics, look at how well management teams have effectively deployed digital transformation strategies to update their business models. Desperation breeds ingenuity, and businesses who embraced digital solutions in a crisis will have greater resiliency in the face of future challenges.

Defining a good target in the “new normal” may prove challenging for investors, especially since now they must navigate a difficulty in valuation and may find themselves in the position of buying at a premium.

Creative Juices Are (Deal) Flowing

As private equity professionals manage their current portfolios while scouring for new deals under these unusual circumstances, fund managers are getting creative with deal-making. The senior debt market struggles, concerns about the validity of pre-coronavirus valuations, and a challenging due diligence environment are all contributors to this development. Pre-existing funds are continuing to raise money, and new funds are popping up to take advantage of openings in the market.

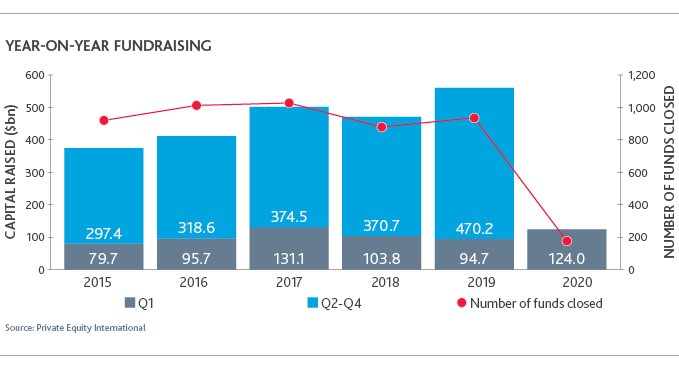

By and large, the private equity industry has quickly adapted to virtual fundraising. In coping with the effects of the pandemic, new platforms are pairing funds with potential investors looking to capitalize on potential new opportunities. While the impact of COVID-19 was not immediately obvious by Q1 2020 fundraising figures, according to Private Equity International, the succeeding quarters are expected to show a sharp slowdown and then a quick rebound as all parties involved get used to virtual fundraising.

Regarding deal flow, there has already been an upsurge in add-on acquisitions during the pandemic as those targets may represent known entities in relation to existing portfolio companies. We’ve seen additional trends in co-investments, PIPE deals, distressed debt and intra-fund transactions.

Co-investments have enjoyed a surge in recent years, but the brakes have been put on in recent months as institutional investors review their risk management processes. Additionally, with co-investments requiring significant due diligence, investors may cool to co-investment deals until they feel comfortable with the marketplace, opting for the relative diversity of a private equity fund.

PIPE deals have reemerged lately as private equity firms have seen opportunities to snap up minority ownership in what have been—and will likely remain—volatile public markets for the foreseeable future. The second quarter of 2020 saw several high-profile PIPE deals valuing in the billions of dollars, and that trend will likely continue until more traditional deal activity can resume.

Distressed debt is another area where private equity is seeing an opportunity to deploy dry powder at a healthy return. The asset class has seen an unsurprising surge so far in 2020, with alternatives data firm Preqin documenting record numbers of distressed debt funds and record capital targeted in June, with additional distressed debt funds seemingly raised every week.

On the other hand, private equity firms are also increasingly considering optimizations that could take place within their existing portfolios, in the form of intra-fund transactions. These transactions can unlock scale and take advantage of synergies arising from any necessary retooling taking place during this time or to compensate for specific portfolio companies disproportionately underperforming at the moment. Since the pandemic has extended holding patterns and exits are being paused for the time being, intra-fund transactions represent one solution to gain more leverage and get back on track for recovery more quickly. Traditionally, intra-fund transactions are an uncommon strategy and for the most part haven’t been deployed over the past decade. But, if it helps a portfolio become stronger and more resilient, then the decision may prove worthwhile.

COVID-19 has triggered the use of several tools in PE’s arsenals that haven’t been leveraged since the last great economic crisis, and yet, even the Great Recession of 2008/2009 pales in comparison to the current global health pandemic.

Traditionally, private equity firms will add value by leveraging past experience—in good times and bad—to improve operations and maximize efficiency for businesses. But in this crisis, historical models on managing cash flow and liquidity have the added layer of complexity of a pandemic that has yet to be fully managed in the United States. Capital preservation and cash flow strategies are still on the table, however, and luckily there is no shortage of dry powder for funds to deploy. Despite unusual circumstances, private equity has an opportunity to thrive if they play their cards right. The bounce-back opportunities are set in place, and as long as firms have a heightened awareness of specific industry needs to manage their investments, the industry as a whole will be en route to recovery.

This article originally appeared in BDO USA, LLP’s “Private Equity” newsletter (August 2020). Copyright © 2020 BDO USA, LLP. All rights reserved. www.bdo.com