By Mike Lorenz, Senior Manager – Valuation & Business Analytics, BDO USA, LLP

Public concern about global warming and the air we breathe means shippers will potentially find themselves operating under increasingly tight rules and thinner margins in the coming years. Like most industries that depend heavily on fossil fuels, shipping is likely to find itself in a complicated position between competing requirements.

Consider the implications of the requirement of the International Maritime Organization (“IMO”), the United Nations’ shipping regulatory agency, that by 2020, shippers reduce their sulfur oxide (SOX). This can be done by:

- Purifying a dirty fuel. Typically, shipping bunker fuel is a leftover (heavy) fuel from the processing of other transportation fuels like kerosene, diesel, and aviation fuel. In order to comply with IMO guidelines, shippers can purchase fuel with reduced sulfur content (0.5% sulfur compared to 3.5% on a mass basis). Lower sulfur fuels require additional processing by refineries, which will prevent shipping companies from purchasing the residual from other refinery processes, and raise costs substantially. Maersk’s Q1 2019 investor report projects the spread between high sulfur fuel and 0.5% compliant fuel to be approximately $200 USD per metric ton (a 60%+ increase)[1].

- Installing a scrubber. Scrubbers have a high upfront cost and require the disposal of a waste stream. Typically, scrubbers take ocean water, remove the SOX with a solvent, and then discharge the residue back into the ocean, killing marine life and releasing a potential carcinogen into the environment[2].

- Substituting an ultra-clean fuel such as gasoil or liquefied natural gas (LNG). Maersk projects gasoil to be almost $100 USD per metric ton more expensive than 0.5%-compliant fuel. LNG is cheaper than gasoil or 0.5%-compliant fuel, but potentially requires additional capital expenditures to convert the engine/generator.

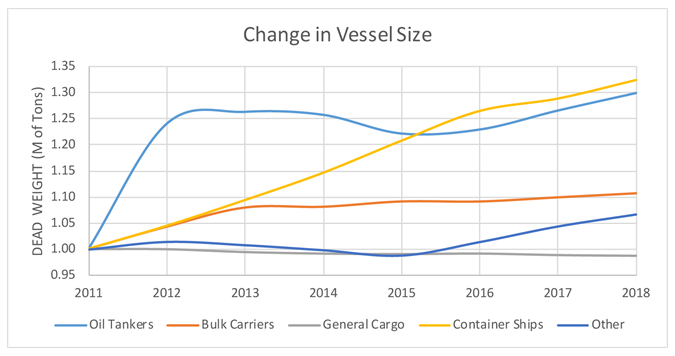

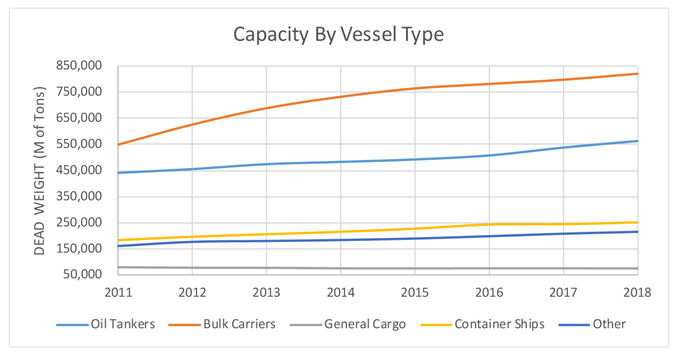

To an extent, some of these fuel cost increases can be countered on a per-unit of weight basis by using larger vessels (Figures 1.3). However, limiting sulfur emissions hinders a different problem: ironically, reducing SOXemissions will increase global warming. SOX is a principal element of acid rain, but SOX also cools the atmosphere. Scientists estimate that global shipping reduced the impact of global warming by 7% in 2000, and success meeting their 2020 SOX reduction targets will mean the planet loses four-fifths of that benefit.

The shipping industry produced about 1 billion tons of the world’s 40 billion tons of carbon dioxide (“CO2”) in 2014, roughly 2.5%. By cutting SOX emissions (which reduced global warming), shipping would potentially need to cut even more GHG emissions than most other industries in order to comply with the Paris Climate Accord. Unfortunately, shipping has limited opportunities to reduce GHG emissions:

- Batteries. The major batteries in use today are lead-acid and lithium-ion, and neither are appropriate for this situation. The drawbacks to batteries in shipping include capital costs for conversion from internal combustion-based prime movers to electric prime movers. Also, shipping over long distances would necessitate carrying a large number of batteries due to a lack of opportunity of charging in the middle of a voyage. Lithium-ion batteries are designed for rapid and regular charging and discharging as the potential energy stored will gradually degrade over time, making lithium-ion a poor choice for long voyages. Lithium-ion batteries also pose a fire risk that may not be tolerable on board ships. Lead-acid batteries are heavier and take up significant space that could affect buoyancy or carrying capacity. Batteries are also only as clean as the energy used during charging. Perhaps new technologies like fuel cells will eventually be more compatible with shipping.

- Fuel conversion. Converting from a higher carbon fuel source like bunker fuel to LNG would reduce emissions. Per the U.S. Energy Information Administration (“EIA”), switching from coal to combined cycle engines fueled with natural gas can reduce CO2 emissions by 40%[3]. However, combustion of bunker fuel likely emits less CO2 than coal per unit of energy and shipping engines are less efficient than combined cycle technology, which will limit some of the potential to reduce GHGs. Another option would be to convert to a carbon-neutral fuel such as bio-diesel or renewable natural gas, but the supply of carbon neutral fuels is an issue.

- More efficiency. Greater efficiency can also reduce GHG emissions. As noted above, larger vessels can potentially reduce fuel costs on a per unit of weight basis. Hull design offers another opportunity for savings. However, new designs generally offer only incremental gains (Bulbous bows, for instance, are now widely used; they cut through the water more efficiently but save only a few percentage points of fuel). A bigger savings for container ships is potentially possible by using logistics software coupled with artificial intelligence to combined kit from different manufacturers into a single container, limiting wasted space.

- Wind. The addition of Flettner rotors, or rotor sails, has been shown to increase fuel efficiency. Rotor sails create forward thrust when wind hits the sail perpendicular to the line of travel. Adding two Norsepower-brand Flettner rotor sails to the 110,000-ton Maersk’s Pelican oil tanker cut the vessel’s fuel bills by 7-10%, and the addition of two more sails would bring the savings to 15-20%[4].

None of these options promises immediate cost savings. On the contrary, many of these solutions have high upfront costs and long recovery periods, and will reduce shippers’ margins (with the exception of filling shipping containers more efficiently). The Flettner rotor sail manufactured by Norsepoer, for example, costs between $1.1M and $2.3M, with a five-year payback period. (However, in this case, costs may fall; Norsepower executives reportedly hope to cut payback to three years by opening a rotor factory with lower labor costs in China)[5].

The pay-back period is particularly important today because most owners operate aging fleets. The typical economic useful life for ships is 20 to 30 years, but the average age of the existing fleet today 20+ years[6]. Reduced profitability due to higher fuel costs could make it even harder for most shippers to take on the debt needed to finance their efficiency investments.

For example, the breakeven point for Flettner rotor sails is currently five years of operation. Six years of operation would result in a return on assets of 6% and 10 years would raise the return to around 15%. The six- to 10-year return is roughly on par with the returns of large shippers. Owners of fleets in their mid-20s, however, may find themselves in a difficult position, unable to justify an investment that would be profitable on a newer ship. Further complicating matters is the fact that the typical ship charter now has a duration of less than three years[7], leaving owners with a potentially dangerous mismatch between the duration of customer contracts and liabilities.

Bigger will be better

If this new operating environment evolves the way we think it will, staying profitable will be progressively more challenging for most smaller and even midsize shippers. Regulation will raise costs, principally through more expensive fuel prices, and just when shippers can least afford to make new investments, the case for larger vessels and other kinds of efficiency improvements will keep getting stronger. As a result, companies with the highest level of profitability will be best able to make the right investments and assuage lender concerns. In other words, today’s biggest and best shipping companies are those most likely to make it through the coming years of de-carbonization.

[1] A.P. Møller-Mærsk A/S, “Q1 2019 Report,” page 33.

[2] The Economist (October 2018) – “Sulphur-emissions rules for shipping will worsen global warming”, Thurrock.

[3] EIA, “Carbon dioxide emissions from electricity generation in 2015 were lowest since 1993.” Wirman, Channele. May 13, 2016.

[4] The Economist (October 2018) – “Wind-powered ships are making a comeback”.

[5] Ibid.

[6] https://www.maritime-executive.com/article/the-global-fleet-revealed

[7] The Economist (October 2018) – “Wind-powered ships are making a comeback”.

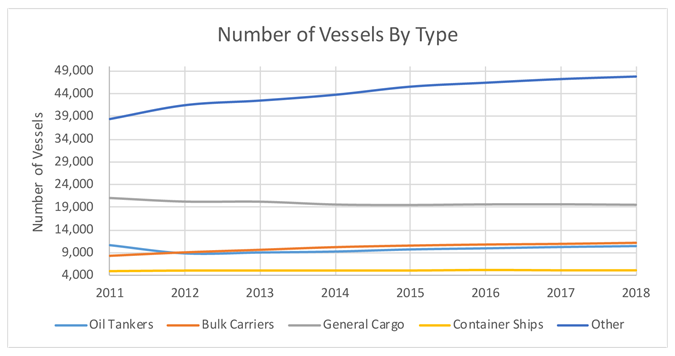

[8] Figures 1-1 and 1-2 based on data from the United Nations Conference on Trade and Development. Figure 1-3 derived by comparing the data in both charts. https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=80100

This article originally appeared in BDO USA, LLP’s “Consulting” newsletter (July 2019). Copyright © 2018 BDO USA, LLP. All rights reserved. www.bdo.com